Rental Income in Nigeria: What People Don’t Talk About Before Investing

A friend once called, excited. He had finally bought a small apartment in Lagos — something he’d planned for years while working abroad. The math looked good. Rent would come in yearly, the property would appreciate, and life would move on. However, he didn’t realize that rental income in Nigeria is not always that easy to calculate.

Six months later, the tone of his calls had changed.

The apartment stayed empty longer than expected. A tenant moved in and delayed payment. A “small plumbing issue” became a major repair. By the time rent finally came in, most of it went back out.

This is the side of rental income in Nigeria that people rarely talk about.

READ MORE: Why “Cheap Land” Is the Most Expensive Mistake Nigerians Make When Buying Land in Nigeria!

Rental Income in Nigeria Is Not Passive by Default

One of the biggest myths around rental income in Nigeria is that it’s automatic.

Buy a property.

Find a tenant.

Collect rent.

In reality, rental income requires active decisions, especially in the first few years. Location, tenant quality, property condition, and management all affect whether income flows smoothly or becomes a constant source of stress.

Rental Income in Nigeria Depends Heavily on Demand, Not Hype

Many investors buy based on what sounds popular. But demand is quieter than hype.

Rental income in Nigeria is strongest where:

- people already live and work

- access roads are reliable

- power and water are manageable

- tenants can realistically afford the rent

A beautiful apartment in the wrong area can stay empty longer than a modest one in the right location.

Vacancy Periods Are Part of the Reality

This is something people don’t like to admit. Even good properties experience vacancy. And every empty month eats into your projected rental income in Nigeria.

Smart investors plan for:

- vacancy periods

- repainting and minor fixes

- marketing time between tenants

Rental income works best when expectations are realistic, not optimistic.

Tenants Matter More Than the Building

Another uncomfortable truth: the tenant can make or break your experience.

Late payments, poor maintenance habits, or constant complaints all affect cash flow and peace of mind. Screening tenants properly is not being difficult — it’s being responsible.

This is why many investors eventually move away from informal, family-managed rentals toward more structured management.

Maintenance Quietly Shapes Rental Income in Nigeria

Maintenance is rarely discussed when people talk about income the at comes from renting properties in Nigeria. Yet it’s one of the biggest factors affecting long-term returns.

Small issues ignored early — leaks, wiring, drainage — grow quietly and become expensive later. Properties that are maintained consistently attract better tenants and experience shorter vacancy periods.

Rental Income Is a Long Game

Earning income from renting properties across Nigeria rewards patience.

The first year often feels tight. The second year feels clearer. Over time, as rent stabilizes and the property settles, income becomes more predictable.

The mistake many people make is expecting immediate ease.

IN OTHER NEWS: DIY Electrical and Plumbing Repairs in Nigeria: When “Managing It” Turns Into Regret

The Part Most People Learn Too Late

The friend I mentioned earlier didn’t make a bad investment. He made an uninformed one.

Once he adjusted expectations, improved tenant screening, and put proper management in place, the property became what he hoped it would be — not perfect, but steady.

Rental income in Nigeria works best when approached with clarity, not assumptions.

TAKE ACTION BEFORE YOU BEGIN

If you’re considering property as a source of rental income, take time to understand the full picture — not just the numbers, but the realities behind them.

The right information upfront can save you years of frustration later.

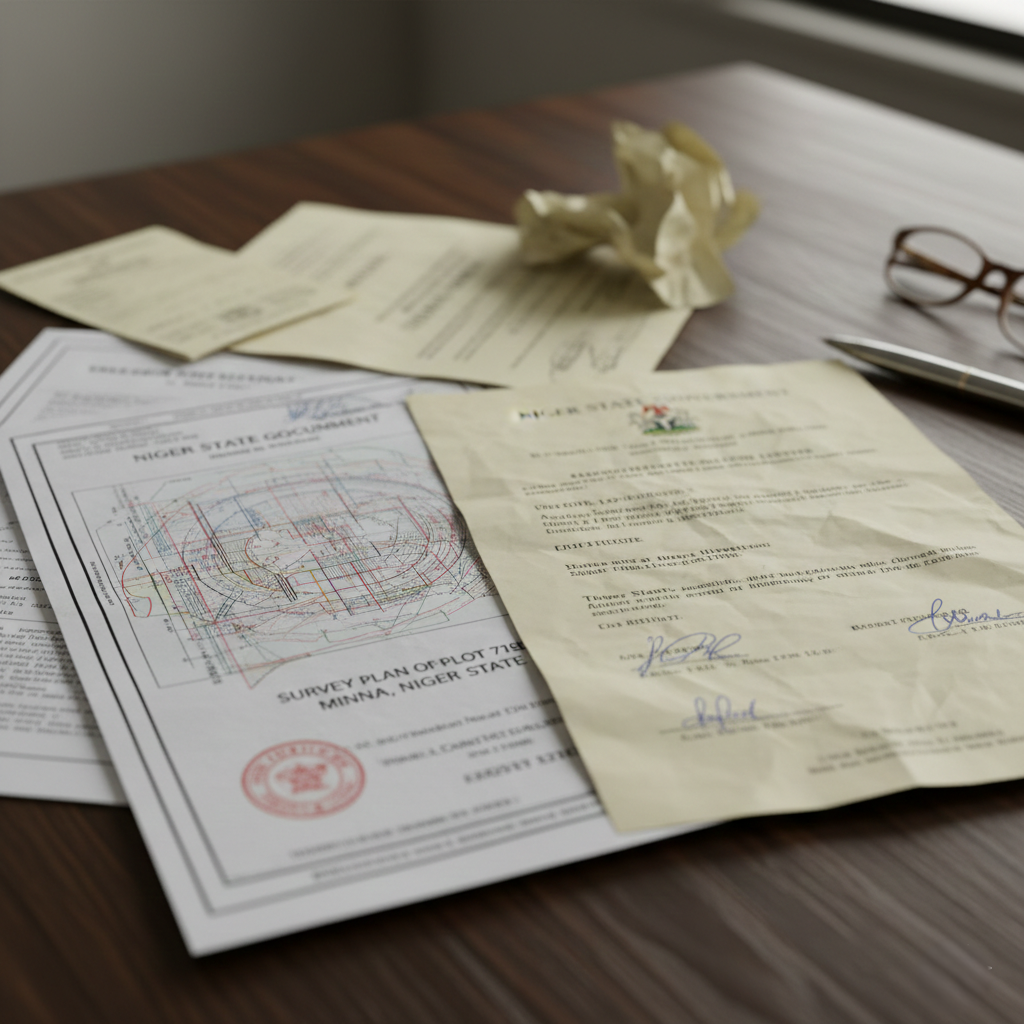

C of O, Gazette, or Deed of Assignment: What Nigerian Property Buyers Must Understand About Land Documents in Nigeria

When Ifunanya finally decided to buy land in Awka, it felt like a turning point in her life. After ten years of working in Abuja, she wanted something permanent. Something hers. But she didn’t take into consideration the fact that land documents in Nigeria is a serious factor to consider before paying for any land.

The seller sounded confident. The land was cheap.

And the documents? “Very complete,” he said.

All she saw was a Deed of Assignment.

Two years later, bulldozers arrived.

The land was reclaimed by the government.

No compensation.

No warning.

What Ifunanya didn’t know was simple — not all Nigeria land documents offer the same protection. And misunderstanding them is one of the most expensive mistakes property buyers make.

Understanding Land Documents in Nigeria Before You Buy

1. What a Deed of Assignment Really Means

A Deed of Assignment only proves that ownership was transferred from one person to another. It does not confirm that the land is legally safe.

If the original owner had no valid title, the deed protects nothing.

2. What Gazette Means in Land Documents in Nigeria

A Gazette shows that land was once acquired by the government and later released to the public.

Important truth:

- Gazette ≠ automatic ownership

- You still need proper registration

Many buyers assume Gazette land is “fully free.” That assumption ruins people financially.

3. Why a Certificate of Occupancy (C of O) Matters Most

A C of O is the strongest land document in Nigeria.

It confirms:

- Government recognition

- Legal right to occupy

- Protection against future claims

No document offers stronger peace of mind.

4. Why Buyers Get Confused About Nigerian Land Documents

- Sellers oversimplify explanations

- Buyers rush decisions

- Emotional attachment clouds judgment

- Lack of professional verification

Land transactions are legal processes — not verbal agreements.

5. What Smart Buyers Do Differently

Smart buyers:

- Verify documents before payment

- Understand what each document covers

- Use professionals, not promises

Property mistakes don’t shout. They surface years later, when it’s too late.

IN OTHER NEWS: Common Construction Scams in Nigeria — And How Smart Property Owners Avoid Them

In Conclusion

Ifunanya now rents. The land she bought exists only in memory.

She says, “If I had understood land documents in Nigeria, I would still own that land today.”

Knowledge doesn’t just save money. It saves dreams, dignity, and future plans.

What You Must Do

Buying land without understanding documents is gambling. Buying with clarity is power.

Connect with House & Land Naija Today

🌐 Website: https://houseandlandnaija.com

📧 Email: hello@houseandlandnaija.com

📍 Offices:

Nigeria — 9 Moses Adebajo Street, Ojodu-Berger, Lagos

USA — 8500 Frederickburgs Lane, Houston TX 77083

Canada — 102-30 El-Tassi Drive, Winnipeg MB

📞 Call Us:

Nigeria: +234 707 491 3626 | +234 707 491 3631

USA: +1 (832) 847-5261

Canada: +1 (431) 990-3777

Before you pay for land, pay for clarity. Talk to professionals. Buy with confidence.

Why “Cheap Land” Is the Most Expensive Mistake Nigerians Make When Buying Land in Nigeria!

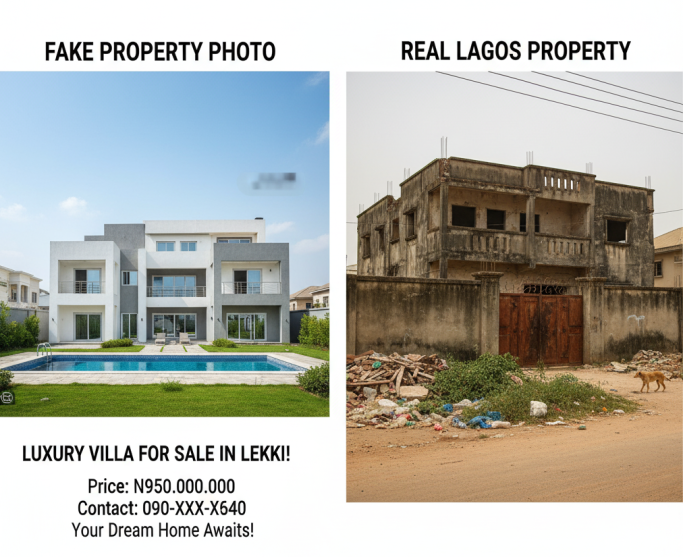

When Sadiq clicked “Send” from his apartment in Abu Dhabi, he smiled. He had been thinking of buying land in Nigeria for a long while. After twelve years of night shifts and missed family gatherings, he was finally buying land back home.

A full plot. Good location. ₦1.6 million.

The agent sounded confident. The pictures looked clean. The documents were neatly scanned.

“This is your breakthrough,” Sadiq told himself.

For weeks, he imagined it. A modest bungalow. A place his parents could retire to. A future he could touch.

Then the call came. Not from the agent. From a friend in Minna who had gone to inspect the land.

“Bro… there’s a problem.”

Silence followed. Red paint splashed across concrete pillars. Government codes scribbled boldly.

ACQUIRED.

In that moment, Sadiq felt something heavier than loss. He felt foolish. Because the land was cheap. And cheap had cost him everything.

This is the painful truth many Nigerians discover too late when buying land in Nigeria.

READ MORE: Things to Check Before Buying Land in Nigeria: A Complete Buyer’s Guide

WHY CHEAP LAND ATTRACTS BUYERS

Let’s be honest. Land prices are high. Income is pressured. Everyone wants a “good deal.”

So when cheap land appears, it feels like opportunity. But in Nigeria, cheap land is rarely cheap by accident. There is usually a reason.

THE HIDDEN PROBLEMS BEHIND CHEAP LAND IN NIGERIA

1. Government Acquisition Issues

Many cheap lands fall under:

- Federal acquisition

- State acquisition

- Pending revocation

Once government interest is involved, ownership becomes meaningless. No matter the receipt you hold.

2. Incomplete or Fake Documentation

Some lands come with:

- Invalid survey plans

- Forged family documents

- Fake excision claims

They look convincing. Until verification begins. And by then, the money is gone.

3. Land Disputes and Multiple Claims

Cheap land often has:

- Family conflicts

- Community disputes

- Multiple sellers

You buy from one party. Another party shows up later. With better claims.

4. Location and Access Risks

Some cheap lands are cheap because:

- Roads are not approved

- Drainage plans don’t exist

- Infrastructure will never come

You save money today. You lose value tomorrow.

WHY CHEAP LAND BECOMES EXPENSIVE

The real cost is not the purchase price.

It is:

- Legal fees

- Survey verification

- Court cases

- Demolition losses

- Emotional stress

Some buyers lose everything. Others spend years trying to “regularize” what should have been clean from day one.

HOW SMART BUYERS BUY LAND IN NIGERIA

Smart buyers don’t chase price. They chase certainty.

They:

- Verify title documents

- Confirm government status

- Inspect land physically

- Engage professionals

- Buy from trusted sources

The one truth they understand is: Safe land is always cheaper than cheap land.

WHY PROFESSIONAL GUIDANCE MATTERS

Land transactions in Nigeria are not simple.

They require:

- Legal checks

- Survey validation

- Government confirmation

- Market understanding

This is why serious buyers work with structured real estate companies. Not roadside promises. Not rushed decisions.

IN OTHER NEWS: Land Ownership And Title Disputes In Nigeria: Understanding The Land Tenure System And Title Verification

CONCLUSION

Sadiq tried again. This time, he slowed down. He asked questions. He verified everything.

The land cost more. But it stood clean. Documents checked out. Peace returned.

And that was when he truly understood:

In Nigeria, the most expensive land is the one you buy cheaply and lose.

📞 CONNECT WITH HOUSE & LAND NAIJA TODAY

🌐 Website: https://houseandlandnaija.com

📧 Email: hello@houseandlandnaija.com

📍 Our Offices

Nigeria: 9 Moses Adebajo Street, Ojodu-Berger, Lagos

USA: 8500 Frederickburgs Lane, Houston TX 77083

Canada: 102-30 El-Tassi Drive, Winnipeg MB

📞 Call Us

Nigeria: +234 707 491 3626 | +234 707 491 3631

USA: +1 (832) 847-5261

Canada: +1 (431) 990-3777

👉 What you should do:

Before you buy land, verify it.

And before you pay, confirm it.

Contact House & Land Naija today.

Find Your Dream Property in Nigeria: Why House & Land Naija Is the First Stop for Verified Nigerian Real Estate Listings Online

From Heartache to Home

Imagine living thousands of miles away — perhaps in Toronto, Houston, or London — and hearing your family back home excitedly talking about a property they saw online. You ask for the link, click, and… it looks perfect. A beautiful apartment in Lagos. A fertile parcel of land in Abuja. A promising estate plot in Port Harcourt. You smile, hopeful that this is the one you’ve been waiting for. You feel convinced that this must be a verified Nigerian property listings online.

Then reality hits: emails go unanswered. The supposed agent turns ghost. The “title documents” are questionable. Your dream begins to feel like another online mirage — just out of reach.

This is the story of far too many Nigerians — at home and abroad — who fall victim to fake listings, unclear documentation, and unverified property deals. But what if there was a safer, smarter way to find your next property? A trusted platform where every listing is verified, every price is transparent, and every property has clear documentation?

Welcome to Houseandlandnaija.com — your digital gateway to verified Nigerian property listings online. Here, your investment becomes real, secure, and truly yours.

🏡 Why You Should Always Visit Houseandlandnaija.com First

When it comes to buying property in Nigeria — whether you’re in Lagos, Abuja, Port Harcourt or any emerging market — your first step should always be finding a reliable, verified listing. That’s exactly what House and Land Naija offers:

✔ Verified Nigerian Property Listings Online

Every property on the platform comes with clear documentation, verified title history, and professional vetting — so you never have to guess or worry about shady deals.

✔ Transparent Information

Forget vague adverts. You’ll see prices, locations, sizes, and verified documents — all right on the website. Plus, you can browse by houses, lands, and commercial properties.

✔ Convenient Search & Personalized Experience

Filter by city, price range, property type, or investment goal — whether you’re buying a family home, an income property, or land for development.

READ MORE: Luxury 2-Bedroom Apartment (N120m)

5-Bedroom Fully Detached Duplex in Lekki (N460m)

🏙️ Featured Properties You Can Explore Today

1. 3-Bedroom Madison Apartment — Lagos (Surulere)

🏡 Price: ₦100,000,000

📍 25 Alhaji Salami Close, Brown Road, Aguda, Surulere

Experience modern living with smart design, fully fitted kitchen, secure gated environment, and amenities that appeal to families and investors alike. This property is ideal for long-term gain or rental income.

2. Peace Park Estate – Port Harcourt

🌳 Price: ₦25,500,000 (465sqm)

📍 Off New Airport Road, Behind OPM Church, Port Harcourt

Secure and accessible land with modern infrastructure, proper drainage and 24/7 security — perfect for building your dream home or long-term investment.

3. The Whit 2-Bedroom Apartment, Surulere, Lagos

📍 Price: ₦100,000,000

Located in one of Surulere’s newest ultra-premium address. Each residence is crafted with exceptional attention to detail, offering spacious layouts, premium finishing, modern kitchens, serene bedrooms, and a refined ambiance designed for comfort and class.

4. 5-Bedroom Duplex – Greenlight Estate, Lagos

🏡 Price: ₦100,000,000

A spacious, family-friendly duplex in Ayobo with full plot access, private compound, and verified Certificate of Occupancy (C of O).

IN OTHER NEWS: Over 60% of Nigeria’s property listings inaccurate – Oikus

🌍 How House and Land Naija Supports You

House and Land Naija isn’t just another property website — it’s your trusted estate partner with:

✔ A team of veteran professionals in real estate, legal, construction, and town planning

✔ A strict “Triple T” verification: True Property, True Value & True Stakeholders

✔ Transparent pricing based on real market value, not guessing

✔ Seamless navigation and focused property browsing experience

🧠 What This Means for You

Whether you’re buying your first home, investing for the future, or securing a place for your family to thrive, Houseandlandnaija.com gives you:

- Verified listings you can trust

- Transparency in pricing and documentation

- A streamlined, worry-free browsing experience

So the next time you think “I want to buy property in Nigeria”, think verified Nigerian property listings online — visit Houseandlandnaija.com first!

📢 Time to Take Action

Don’t make another investment decision without the right information. Head to Houseandlandnaija.com now and start browsing verified Nigerian property listings online that match your goals — whether at home or abroad!

Contact House and Land Naija Today:

🌐 https://houseandlandnaija.com

📧 hello@houseandlandnaija.com

📞 Nigeria: +234 707 491 3626 | +234 707 491 3631

📞 Canada: +1 (431) 990-3777

📞 USA: +1 (833) 323-4927

House and Land Naija — Your home starts here.

How Nigerians in the Diaspora Can Avoid Real Estate Scams and Fake Listings When Buying Property at Home

Fake Listings and Real Estate Scams are Severely Affecting Nigerians

When Chika moved to the UK, one of her biggest dreams was owning a home back in Lagos — a place she could return to someday and call her own. She saved for years, scrolling through countless real estate listings online. One day, she found the one: a newly-built duplex in Surulere that seemed perfect — modern design, “verified” documents, and a price that felt just right. At that point, Chika hadn’t learned how Nigerians in the diaspora can avoid real estate scams and fake listing when buying property back at home.

She sent money to an “agent” her friend recommended, and waited eagerly for updates. But weeks later, calls went unanswered. The “office” she was told to visit didn’t exist. The property photos? Stolen from another developer’s page.

Sadly, Chika’s story is one too many Nigerians — both at home and abroad — can relate to. Across Nigeria, misleading adverts, fake listings, and poor data transparency have become some of the biggest threats to real estate investors. Whether you’re buying your first plot of land in Lekki or building your retirement home in Enugu, the risk of losing your money to deceitful practices is real.

But this is not where the story has to end. There’s a smarter way to buy — and that’s where verified property transparency comes in.

READ MORE: Beyond the Façade: How Nigeria’s Infrastructure Gap Impacts Your Real Estate Investment.

The Real Estate Reality in Nigeria

Nigeria’s real estate sector continues to boom — driven by urban migration, the diaspora’s appetite for home investment, and rapid development across major cities.

However, the market also faces significant challenges:

- Fake property listings on social media and websites that misrepresent ownership or value.

- Weak market data that makes it hard for buyers to verify property histories or price benchmarks.

- Unverified agents and middlemen who operate without clear documentation or regulatory oversight.

A report by ResearchGate (2024) highlights that over 65% of Nigerian property buyers rely solely on agent claims without demanding verifiable ownership proof. This lack of transparency weakens investor confidence and fuels fraud.

What Experts Are Saying

According to leading real estate experts in Lagos and Abuja:

“Transparency is the backbone of trust in property investment. Every investor, especially Nigerians in the diaspora, must demand proof — verified titles, survey plans, and transaction histories — before paying a dime.”

Others emphasize that Nigeria’s real estate market will only gain global investor confidence when listing verification systems and market data dashboards become standard industry practice.

In other words, the problem isn’t that Nigerians aren’t buying; it’s that they no longer know who to trust. It is important to learn how Nigerians in the diaspora can avoid real estate scams and fake listings when buying properties at home.

How to Overcome the Transparency Trap

To protect yourself and your hard-earned money, here’s what every smart investor should do:

1️⃣ Insist on Verified Documentation

- Request copies of the property’s C of O, deed of assignment, survey plan, and tax receipts.

- Ensure the documents are verified with the Lagos State Land Bureau or relevant state agencies.

2️⃣ Work Only with Verified Platforms

- Avoid random social media listings.

- Use platforms like House and Land Naija where every property undergoes multi-stage verification, including document checks and third-party authentication.

3️⃣ Demand Transparency Reports

- Ask for transaction history, project progress updates, and valuation reports.

- These data points show you’re not buying into a ghost project.

4️⃣ Use Tech to Your Advantage

- Virtual property inspections and digital document verification help diaspora buyers view real-time conditions before purchase.

How House and Land Naija Makes It Easy

At House and Land Naija, we understand how emotional and sensitive real estate investments are — especially for Nigerians in the diaspora who can’t be physically present.

That’s why we provide:

✅ Verified Property Listings: Every home and land on our platform is screened through multi-layer title and survey verification.

✅ Transparent Pricing: You see real prices — no hidden costs or middlemen surprises.

✅ Virtual Inspections: We organize live video tours for diaspora clients, so you can “see before you buy.”

✅ Market Data Insights: Our data dashboards show you comparable sales and price trends in your desired area.

With House and Land Naija, you’re not just buying property — you’re building confidence, trust, and a lasting investment legacy. Yes, you will learn how Nigerians in the diaspora can avoid real estate scams and fake listings when buying property back at home.

Chika’s Second Chance

Months after her loss, Chika found House and Land Naija through a fellow investor. With proper guidance, she verified her next property in Surulere, reviewed authentic documents, and joined a live virtual inspection.

Today, she’s a proud homeowner — not of promises, but of proof.

Her story is a reminder that transparency is the foundation of every lasting investment. Whether you’re in Abuja, London, or Toronto, don’t just buy a house — buy peace of mind.

At House and Land Naija, we turn that dream into a safe reality — by standing for True Property, True Value, and True Stakeholders.

IN OTHER NEWS: From Dream to Disaster: Why Building Your Nigerian Home from Abroad Fails

Time to Take Action

It’s time you learned how Nigerians in the diaspora can avoid real estate scams and fake listings. Act now. Secure your property in Nigeria through verified agents that will help you to protect your investments.

📢 Connect with House & Land Naija Today

🌐 Website: https://houseandlandnaija.com

📧 Email: hello@houseandlandnaija.com

📍 Our Offices Worldwide

- Canada: 102-30 El-Tassi Drive, Winnipeg MB, Canada

- USA: 8500 Frederickburgs Lane, Houston TX 77083

- Nigeria: 9 Moses Adebajo Street, Ojodu-Berger, Lagos

📞 Call Us Anytime

Nigeria: +234 707 491 3626 | +234 707 491 3631

Canada: +1 (431) 990-3777

USA: +1 (832) 847-5261

Don’t wait until you regret a purchase. Let’s ensure your next property is trusted, verified and built to grow.

🏗️ Invest Smart, Build Safe: How to Avoid the Collapse Crisis in Nigeria

Broken Home, Broken Dreams

In 2023, Chinedu, a Nigerian tech entrepreneur living in Atlanta, sent millions of naira back home to build a dream duplex for his aging parents in Owerri. But months later, his joy turned into heartbreak: cracks snaked across the walls, ceilings sagged, and engineers soon declared the building unsafe. The culprit? Cheap materials and an unsupervised contractor who cut corners at every stage. What a sad end to his wonderful dreams! This article will guide on you on how to avoid the collapse crisis in Nigeria.

Chinedu’s story mirrors the silent crisis Nigerians at home and abroad face: buildings collapsing, dreams turning to rubble, lives lost, and hard-earned money wasted. Yet, it doesn’t have to be this way. With the right steps, you can ensure your investment stands tall, safe, and enduring — whether you live in Lagos, London, or Los Angeles.

READ MORE: Hidden Costs to Watch Out For When Buying Properties in Nigeria

Why Buildings Collapse in Nigeria — A Crisis We Must Face

- Poor design & shortcuts: Many projects ignore proper engineering calculations.

- Cheap or fake materials: Adulterated cement, weak iron rods, and bad concrete mixes.

- No soil or site testing: Foundations fail when they sit on unstable land.

- Lack of supervision: Unskilled labor and absent oversight let errors slide.

- Regulatory lapses & corruption: Approvals are given without true inspections.

- Neglected maintenance: Small cracks, leaks, and corrosion worsen over time.

👉 For Nigerians in the Diaspora, these risks are amplified when you’re not physically present to monitor projects.

How to Invest Smart and Build Safe

1. Hire Licensed Professionals Only

Don’t settle for “my brother’s friend.” Demand architects, engineers, and contractors registered with the Council for the Regulation of Engineering in Nigeria (COREN) or Nigerian Institute of Architects.

2. Always Begin with Soil Testing

Your dream home is only as strong as its foundation. Without geotechnical tests, you’re gambling with the land beneath.

3. Buy Quality Materials — And Verify Them

Insist on receipts, test certificates, and site delivery logs. Fake materials are a hidden killer in the industry.

4. Insist on Independent Supervision

Hire a clerk of works or supervisor whose loyalty is to you, not the contractor. Even better, demand weekly photo and video reports if you’re abroad.

5. Plan for Drainage & Environment

Nigeria’s floods and erosion are notorious. Build with drainage, gutters, and flood-resistant measures in mind.

6. Create a Maintenance Culture

Even the strongest buildings weaken without upkeep. Regular inspections save millions in future repairs.

Special Tips for Nigerians in the Diaspora

- Use contractor performance bonds to safeguard your investment.

- Enforce staged payments — release funds only after certified milestones.

- Insist on geo-tagged photo and drone inspections to keep eyes on the ground.

- Keep all documents (drawings, test results, contracts) stored in the cloud.

IN OTHER NEWS: ICPC, COREN Join Forces to End Building Collapse

Quick Diaspora Checklist ✅

- Soil test report secured

- Stamped structural drawings approved

- Verified contractor credentials

- Materials tested and logged

- Independent site supervision arranged

- Drainage/erosion control included

- Maintenance plan in place

Conclusion

When Chinedu rebuilt his parents’ duplex, he did things differently: soil tests, vetted engineers, and weekly drone footage of the site. This time, his investment stood firm — not just a house, but a legacy.

For Nigerians at home and abroad, the message is clear: you don’t just build houses, you build futures. Don’t let yours collapse under shortcuts. Following this guide will help you learn how to avoid the collapse crisis in Nigeria.

Think smart. Plan safely. Build legacy.

📞 House and Land Naija is Here for You!

At House and Land Naija, we help you:

- Vet contractors and materials

- Supervise projects independently

- Provide drone/video reporting for diaspora clients

- Ensure every block you lay meets global safety standards

🌍 Website: houseandlandnaija.com

Email: hello@houseandlandnaija.com

📞 Canada: +1 (431) 990-3777

📞 USA: +1 (832) 847 5261

📞 Nigeria: 090 880 739 63

Hidden Costs to Watch Out For When Buying Properties in Nigeria

What every Nigerian at home — and in the Diaspora — must know before they sign, pay, or build.

A Diaspora Cautionary Tale

Ufuoma had been saving for years while working in Dubai. She found a “sweet” plot in Lekki online and thought she’d secured a bargain. She wired the seller an upfront allocation fee, then paid for a surveyor and a builder — only to discover later she still needed governor’s consent, a long court search, and an unexpected infrastructure levy from the developer. The small “hidden” fees snowballed, and her savings were stretched thin. No one told her that were hidden costs to watch out for when buying properties in Nigeria. With better planning, a trusted agent and a 20% contingency fund, Ufuoma would have avoided stress and preserved cash for construction!

If you’re buying property in Nigeria — whether you’re in Lagos or abroad — Ufuoma’s story should be your wake-up call: the purchase price is only the beginning.

Why This Matters To You

Hidden costs can add 10%–40% (sometimes more) to your out-of-pocket total, delay your project, and expose you to legal risk. Understanding them upfront protects your money, timing, and long-term returns. So if you live abroad and desire to own a property in Nigeria, this article will show you all the hidden costs to watch out for when buying properties in Nigeria!

READ MORE: DIASPORA DOLLARS, REAL RISK: HOW TO AVOID LAND SCAMS IN NIGERIA!

The Full List — Hidden Costs Every Buyer Must Watch For

Below are the usual suspects and how they commonly show up. I list each cost, why it matters, who typically charges it, and how to manage or reduce it.

1) Agent / Finder’s Commission

- What it is: Fee paid to the estate agent or broker for sourcing the property.

- Why it matters: Often 2–7% of the sale price (varies by agreement). Can be added to your price unexpectedly.

- How to manage: Agree fees in writing before any viewing or negotiation. If you’re overseas, use an agent you’ve vetted and paid via escrow.

2) Legal Fees & Conveyancing Costs

- What it is: Lawyer fees to draft/pull title docs, carry out due diligence, draft the sale agreement, and handle registration.

- Why it matters: You need a lawyer to avoid title problems; cutting corners risks losing everything.

- How to manage: Request an itemized quote and scope of work. Use lawyers who specialize in property conveyancing and ask for references.

3) Title Searches / Land Registry & Search Fees

- What it is: Official searches at the state land registry, court checks for litigation, and search certificates.

- Why it matters: Proves whether a property has encumbrances or multiple claims. Missing this = high legal risk.

- How to manage: Don’t accept verbal assurances. Require registry certificates and copies of searches before payment.

4) Surveyor Fees & Revalidation of Survey Plans

- What it is: Professional survey to verify boundaries, peg positions, and area — and fees to update or revalidate old survey plans.

- Why it matters: Prevents double-sales; ensures you buy the plot you think you bought.

- How to manage: Always instruct an independent licensed surveyor; require a stamped survey plan as a condition of sale.

5) Governor’s Consent (where applicable) & Certificate Issuance Fees

- What it is: For certain transfers (e.g., from an individual), state law requires governor’s consent; this attracts processing fees and sometimes time.

- Why it matters: Transfers without proper consent can be voidable. It can be costly and time-consuming.

- How to manage: Confirm whether consent is required for your transaction and budget time and money for the process.

6) Stamp Duty & Registration Fees

- What it is: Government taxes on instruments and formal registration fees. Rates vary by state and document type.

- Why it matters: Stamp duty is legally required; an unstamped instrument may not be admissible in court. Registration legalizes ownership.

- How to manage: Ask your lawyer to calculate and include these in the closing budget; obtain official receipts.

7) Allocation fees, Development Levies & ‘Estate’ Charges (Developer Fees)

- What it is: Charges by developers for allocating a plot, and later charges for roadworks, drainage, gatehouses, or “facilities development”.

- Why it matters: Some developers bill major levies after allocation; ignore at your peril.

- How to manage: Get a full, written breakdown of developer fees before paying. Insist on escrow for major payments.

8) Service Charges / Estate Maintenance / Homeowners’ Association (HOA) Fees

- What it is: Recurring fees for security, road maintenance, landscaping and utilities in gated communities.

- Why it matters: These are recurring and impact your annual cost of ownership. Some estates charge upfront lump sums.

- How to manage: Clarify recurring amounts, billing frequency, and what they cover. Factor into long-term running costs.

9) Utility Connection Costs (Electricity, Water, Fiber)

- What it is: Meter installations, service connection fees from providers, or paying for trenching/connection work.

- Why it matters: These can be sizeable, especially for rural plots or new estates.

- How to manage: Ask the developer or local utility provider for connection quotes before you commit.

10) VAT on Materials, Contractor Bills & Building Permit Fees

- What it is: VAT on construction materials and services; permit fees for building plans and approvals.

- Why it matters: Construction is expensive; VAT and permit costs will increase your budget.

- How to manage: Budget for VAT and include it in construction quotes. Factor local planning and permit timelines into schedule.

11) Infrastructure / Impact Levies and Local Government Charges

- What it is: Town planning levies, drainage contributions or environmental levies assessed by local authorities.

- Why it matters: They can be demanded later as cities formalize services.

- How to manage: Confirm with the developer and local authority what levies exist and whether they’ve been paid.

12) Ground Rent or Customary Land Charges

- What it is: For certain customary lands, annual dues or payments to traditional rulers may be expected.

- Why it matters: These reappear annually and can cause tension if ignored.

- How to manage: Clarify any customary obligations with community leaders and put them in writing.

13) Mortgage / Loan Arrangement Fees, Valuation Fees and Insurance

- What it is: Bank processing fees, legal fees charged by lenders, valuation fees and life/home insurance.

- Why it matters: Borrowing costs add materially to loan TCO. Some banks charge non-refundable processing fees.

- How to manage: Shop lenders, compare fees, and get a full amortization schedule from the bank.

IN OTHER NEWS: How Real Estate Displaced Crude Oil as Nigeria’s Third Largest GDP Contributor

14) Exchange-rate Losses and Foreign Transfer Charges (for Diaspora)

- What it is: When sending funds from abroad you will pay FX spreads, bank charges and sometimes poor conversion rates.

- Why it matters: Can consume several percentage points of your transferred capital.

- How to manage: Use trusted remittance services, ask for Nigerian-naira invoices, and plan transfers when exchange rates are favorable.

15) Title Insurance (optional but useful)

- What it is: Insures against title defects, fraud, or title disputes that emerge after purchase.

- Why it matters: It’s an extra cost but can be a lifesaver if title risk is non-trivial.

- How to manage: Where available, compare policies and weigh cost vs. risk for high-value purchases.

16) Unexpected Construction Cost Overruns & Contingency

- What it is: Material price inflation, design changes, or site surprises (soil issues, remediation).

- Why it matters: Construction often exceeds budget. Unforeseen costs can derail projects.

- How to manage: Hold a contingency fund (10–25% common) and use fixed-price contracts where possible.

17) Taxes & Annual Property Rates (Local Government)

- What it is: Annual property tax/rates charged by local authorities; enforcement is rising in many urban areas.

- Why it matters: Recurring tax that affects holding cost and net returns.

- How to manage: Clarify tax obligations with local government and build into your cash flow.

So if you live abroad and desire to own a property in Nigeria, this article has shown you all there is to know about the hidden costs to watch out for when buying properties in Nigeria!

Practical checklist — Budget and Negotiation Steps (Use This Before You Sign Anything)

- Ask for a full cost breakdown (sale price + every fee).

- Confirm who pays what (seller vs buyer vs developer).

- Insist on original documents (C of O, survey plan, allocation letter).

- Order an independent survey and lawyer-conducted title search.

- Ask for escrow or lawyer trust account for all major payments.

- Check for developer levies and any post-allocation fees in writing.

- Plan a contingency of 10–25% of total budget.

- If abroad: use geo-tagged video, drone footage and a trusted on-the-ground rep.

- Get a signed receipt for every payment and official transaction evidence.

- Ask for copies of service charge agreements and estate rules.

How Following These Recommendations Benefits You

- Greater Certainty — no surprise fees after you commit.

- Legal Safety — fewer chances of losing your purchase to title defects.

- Better Returns — protecting capital increases your net ROI when you sell or rent.

- Peace of mind — you can invest from overseas without fear, using verifiable processes.

- Project success — fewer delays from unpaid levies, missing permits or misbudgeted builds.

In Conclusion

Buying property in Nigeria is one of the best ways to build wealth — but only when you plan for the full cost. Hidden fees don’t have to be a surprise. With the right lawyer, surveyor and trusted partner on the ground, you can invest confidently from anywhere in the world. So if you live abroad and desire to own a property in Nigeria, this article has shown you all the hidden costs to watch out for when buying properties in Nigeria!

If you want, House and Land Naija can:

- verify title documents on your behalf,

- arrange independent surveys and drone inspections,

- hold funds in escrow with a trusted lawyer, and

- provide an itemized closing budget so you know every naira you’ll need.

Let us help you buy smart and build your legacy.

Contact House and Land Naija to get a full purchase cost worksheet for any property you’re considering.

Ready to Invest with Confidence? Contact House and Land Naija Today

- Visit: houseandlandnaija.com

- Address: Nigeria Office – 9 Moses Adebajo Street, Ojodu, Lagos State

- Address: Canada Office – 102‑30 El‑Tassi Drive, Winnipeg MB, Canada

- Address: USA Office: 8500 Fredericksburg Lane, Houston TX 77083

- Phone (Canada): +1 (431) 990‑3777

- Phone (USA): +1 (833) 323‑4927

- Phone (Nigeria): 070 7 491 36 38

Join the thousands of Nigerians—home and abroad—who’ve secured legitimate, high-value property deals.