Property as a Long-Term Asset, Not a Quick Flip

A few years ago, Akin, a young Nigerian professional living in Tokyo, Japan, proudly bought his first apartment in Abuja. His plan was simple: renovate slightly, resell quickly, and move on to the next deal. He, like many other Nigerians, did not view property as a long-term asset; it was just a means to make quick money.

But the market didn’t move as fast as he expected. Buyers negotiated aggressively. Holding costs increased. What was meant to be a quick profit turned into months of waiting.

Eventually, instead of selling, Akin rented the property out. Years later, that same apartment — held patiently — appreciated far beyond what the original flip would have earned. That’s the quiet power of viewing property as a long-term asset instead of a quick flip.

READ MORE: Rental Income in Nigeria: What People Don’t Talk About Before Investing

Property as a Long-Term Asset Builds Stability

When you approach property as a long-term asset, your decisions change.

You care more about:

- infrastructure growth

- rental demand

- structural quality

- long-term livability

Instead of chasing short-term price differences, you focus on durability and location fundamentals. In Nigeria, where markets fluctuate and development unfolds gradually, patience often outperforms urgency.

Property as a Long-Term Asset Reduces Pressure

Quick flips depend heavily on timing. If market demand slows, profits shrink. But property as a long-term asset allows time to work in your favor.

Rental income supports holding costs. Infrastructure projects increase surrounding value. Population growth strengthens demand.

Long-term ownership absorbs temporary market slowdowns better than short-term speculation.

Property as a Long-Term Asset Encourages Better Choices

When flipping, cosmetic upgrades often take priority. When investing long-term, quality matters more than appearance.

Stronger foundations. Reliable plumbing. Durable roofing. Sustainable maintenance plans.

When you buy property that you intend to own in the long-term rewards thoughtful construction and consistent upkeep — not shortcuts.

The Quiet Advantage of Time

Nigeria’s real estate history shows something consistent: well-located properties held over time tend to appreciate. Not overnight. Not dramatically every year. But steadily.

Many seasoned investors will admit this privately: their best-performing properties were the ones they almost sold too early.

A Different Way to Measure Success

The young investor who planned a quick flip now sees his property differently. It provides steady rental income. Its value has grown. And it offers flexibility — sell when ready, not when pressured.

Property as a long-term asset isn’t about avoiding profit. It’s about building it sustainably.

IN OTHER NEWS: Your Property, Perfectly Managed

A Thought Before Your Next Purchase

Ask yourself: Am I buying for speed — or for stability?

Because the strategy you choose shapes the outcome you get.

Keep The Right Focus

If you’re considering property investment, think beyond short-term gains. Focus on structure, location, and sustainability.

A long-term mindset often builds stronger returns — and greater peace of mind.

Buying From Individuals vs Estates: What to Watch For Before You Pay

A buyer once shared a story that stayed with me. He had found what seemed like the perfect property in Lagos. The price was fair. The location was solid. The seller was polite and confident. Documents were presented. Everything looked straightforward. But he didn’t know that there is a difference between buying from individuals vs estates.

Six months after payment, a letter arrived from a lawyer. The property, he discovered, was part of a family estate. Not all beneficiaries had signed off. What followed was not construction or renovation — but court dates and stress.

This is why buying from individuals vs estates in Nigeria requires more than surface-level checks. It’s not about suspicion. It’s about structure.

READ MORE: How to Buy Property in Nigeria Without Being Physically Present

Buying From Individuals vs Estates: Understanding the Difference

When buying property in Nigeria, transactions usually fall into two broad categories:

- You’re buying directly from an individual owner.

- You’re buying from an estate — meaning the property belonged to someone deceased and is now controlled by heirs or administrators.

At first glance, both may look the same. But legally and practically, they are not. Understanding the difference is the first step in safely navigating buying from individuals vs estates.

Buying From Individuals vs Estates: When the Seller Is an Individual

Buying from a living individual can feel simpler. There is usually one primary decision-maker. Documents are often easier to trace. But simplicity can be misleading.

Before paying, you must confirm:

- The seller is the true owner listed on the title.

- There are no outstanding disputes.

- The property is not jointly owned without disclosure.

- There are no encumbrances or pending legal issues.

Even in individual sales, due diligence is not optional.

Buying From Individuals vs Estates: The Extra Layer of Estate Sales

This is where caution becomes even more important. When a property forms part of an estate, it means ownership has transitioned due to death. Legally, that property cannot simply be sold by one family member unless proper authority has been granted.

Things to verify include:

- Has probate or letters of administration been obtained?

- Who are the legally recognized administrators?

- Have all beneficiaries consented?

- Is there written, documented approval for the sale?

Buying from individuals vs estates becomes risky when buyers assume family agreement equals legal authority. They are not the same.

Emotional Pressure and Family Dynamics

Estate properties often come with urgency.

A family may want to “settle matters quickly.” You may hear phrases like:

- “We have all agreed.”

- “We are all one family.”

- “Don’t worry, everything is fine.”

In many cases, they mean well. But family dynamics can change after money changes hands.

Buying from individuals vs estates requires protecting your investment from future disagreements that haven’t happened yet.

Why Professional Verification Matters

One of the most overlooked risks in buying from individuals vs estates is incomplete documentation.

A proper review at the Land Registry, verification of probate records, and confirmation of consent signatures can prevent years of legal entanglement.

The cost of verification is always smaller than the cost of litigation.

A Quiet Lesson Many Learn Too Late

The buyer I mentioned earlier eventually resolved his case — but not without legal fees, delays, and emotional exhaustion.

The property was not the problem. The process was.

Buying from individuals vs estates is not inherently dangerous. Many successful transactions happen every day. The difference lies in whether the buyer approached the process casually or carefully.

IN OTHER NEWS: Land banking: The sleeping goldmine in Nigeria’s real estate market

A Thought Before You Transfer Funds

Property in Nigeria is not just an asset — it’s layered with history, family ties, and legal structure.

Before you make payment, pause.

Ask questions.

Verify documents.

Insist on clarity.

Because once money changes hands, reversing mistakes becomes much harder.

WHAT YOU SHOULD DO

If you’re considering buying property and are unsure whether it’s an individual or estate sale, take time to understand the structure behind the transaction.

A calm, informed decision today can save years of avoidable stress tomorrow.

Rental Income in Nigeria: What People Don’t Talk About Before Investing

A friend once called, excited. He had finally bought a small apartment in Lagos — something he’d planned for years while working abroad. The math looked good. Rent would come in yearly, the property would appreciate, and life would move on. However, he didn’t realize that rental income in Nigeria is not always that easy to calculate.

Six months later, the tone of his calls had changed.

The apartment stayed empty longer than expected. A tenant moved in and delayed payment. A “small plumbing issue” became a major repair. By the time rent finally came in, most of it went back out.

This is the side of rental income in Nigeria that people rarely talk about.

READ MORE: Why “Cheap Land” Is the Most Expensive Mistake Nigerians Make When Buying Land in Nigeria!

Rental Income in Nigeria Is Not Passive by Default

One of the biggest myths around rental income in Nigeria is that it’s automatic.

Buy a property.

Find a tenant.

Collect rent.

In reality, rental income requires active decisions, especially in the first few years. Location, tenant quality, property condition, and management all affect whether income flows smoothly or becomes a constant source of stress.

Rental Income in Nigeria Depends Heavily on Demand, Not Hype

Many investors buy based on what sounds popular. But demand is quieter than hype.

Rental income in Nigeria is strongest where:

- people already live and work

- access roads are reliable

- power and water are manageable

- tenants can realistically afford the rent

A beautiful apartment in the wrong area can stay empty longer than a modest one in the right location.

Vacancy Periods Are Part of the Reality

This is something people don’t like to admit. Even good properties experience vacancy. And every empty month eats into your projected rental income in Nigeria.

Smart investors plan for:

- vacancy periods

- repainting and minor fixes

- marketing time between tenants

Rental income works best when expectations are realistic, not optimistic.

Tenants Matter More Than the Building

Another uncomfortable truth: the tenant can make or break your experience.

Late payments, poor maintenance habits, or constant complaints all affect cash flow and peace of mind. Screening tenants properly is not being difficult — it’s being responsible.

This is why many investors eventually move away from informal, family-managed rentals toward more structured management.

Maintenance Quietly Shapes Rental Income in Nigeria

Maintenance is rarely discussed when people talk about income the at comes from renting properties in Nigeria. Yet it’s one of the biggest factors affecting long-term returns.

Small issues ignored early — leaks, wiring, drainage — grow quietly and become expensive later. Properties that are maintained consistently attract better tenants and experience shorter vacancy periods.

Rental Income Is a Long Game

Earning income from renting properties across Nigeria rewards patience.

The first year often feels tight. The second year feels clearer. Over time, as rent stabilizes and the property settles, income becomes more predictable.

The mistake many people make is expecting immediate ease.

IN OTHER NEWS: DIY Electrical and Plumbing Repairs in Nigeria: When “Managing It” Turns Into Regret

The Part Most People Learn Too Late

The friend I mentioned earlier didn’t make a bad investment. He made an uninformed one.

Once he adjusted expectations, improved tenant screening, and put proper management in place, the property became what he hoped it would be — not perfect, but steady.

Rental income in Nigeria works best when approached with clarity, not assumptions.

TAKE ACTION BEFORE YOU BEGIN

If you’re considering property as a source of rental income, take time to understand the full picture — not just the numbers, but the realities behind them.

The right information upfront can save you years of frustration later.

How to Buy Property in Nigeria Without Being Physically Present

When Kunle boarded his flight back to Manchester, he believed his biggest dream was finally in motion. He believed he knew how to buy property in Nigeria without being physically present.

He had sent money home to buy land in Ibeju-Lekki. Family members promised to “handle everything.” Photos were sent. Receipts were shared. Reassurances flowed freely.

Six months later, Kunle returned to Nigeria for a visit. The land he paid for? Someone else was already fencing it.

What Kunle experienced is not rare. It’s the painful reality many Nigerians abroad face — buying property from a distance without a trusted system.

Yet, people are still buying property in Nigeria successfully, even without being physically present. The difference is how they do it.

How to Buy Property in Nigeria Without Being Physically Present — Safely

1. Stop Relying on Verbal Promises

Buying property remotely based on trust alone is risky. Pictures can be staged. Stories can be adjusted.

Documentation and verification matter more than emotions.

2. Verify Land Documents Before Any Payment

To buy property in Nigeria without being physically present, documents must be checked professionally:

- Title status

- Government records

- Ownership history

This step alone prevents years of regret.

3. Independent Physical Inspection Is Non-Negotiable

Someone must physically inspect:

- The exact location

- Boundaries

- Accessibility

- Existing disputes

A video call walkthrough is good. A professional inspection is better.

4. Use a Structured Payment Process

Avoid lump-sum transfers based on assumptions.

Payments should be:

- Milestone-based

- Document-backed

- Traceable

This protects you when things don’t go as planned.

5. Demand Updates and Written Reports

Remote buyers succeed when they:

- Receive regular updates

- Get visual evidence

- Maintain documentation trails

Silence is a warning sign.

Why Many Fail to Buy Property Remotely

- Over-trusting relatives or friends

- Rushing decisions out of excitement

- Skipping professional verification

- Fear of service fees (that later save millions)

Buying property in Nigeria without being physically present is possible — but only with structure.

IN OTHER NEWS: Firm advocates diaspora property purchase

Conclusion

Kunle eventually bought another property — this time through professionals.

Every step was verified. Have every document explained. And have every payment accounted for.

Today, his land is secure. Registered. Undisputed.

He learned the hard way, but you don’t have to.

Best Action To Take

Buying property from afar doesn’t have to end in regret.

Connect with House & Land Naija Today

🌐 Website: https://houseandlandnaija.com

📧 Email: hello@houseandlandnaija.com

📍 Offices:

Nigeria — 9 Moses Adebajo Street, Ojodu-Berger, Lagos

USA — 8500 Frederickburgs Lane, Houston TX 77083

Canada — 102-30 El-Tassi Drive, Winnipeg MB

📞 Call Us:

Nigeria: +234 707 491 3626 | +234 707 491 3631

USA: +1 (832) 847-5261

Canada: +1 (431) 990-3777

Don’t send money blindly. Buy with clarity. Buy with confidence. Let professionals guide you!

Things to Check Before Buying Land in Nigeria: A Complete Buyer’s Guide

When Mr. Abraham finally returned from Canada for Christmas, he was excited. A family friend had “secured” a cheap land for him on the outskirts of Abuja. He didn’t realize that there were things to check before buying land in Nigeria.

The pictures looked perfect.

The price sounded like a miracle.

Three months later, bulldozers arrived.

Not to build his dream home — but to demolish everything on that land.

The land belonged to the government.

What started as excitement turned into silence, regret, and loss.

This painful experience is why every buyer must understand the things to check before buying land in Nigeria.

1. Verify Ownership — Don’t Trust Stories

Never rely on verbal assurances.

Ask for:

- Title documents

- Survey plan

- Seller’s means of identification

Confirm ownership at the land registry. One verification can save you millions.

2. Understand the Land Title

Not all land titles are equal.

Know the difference between:

- Certificate of Occupancy (C of O)

- Gazette

- Excision

Each title affects:

- Security

- Resale value

- Development approval

If you don’t understand it, don’t buy yet.

3. Conduct a Proper Survey

A registered surveyor will:

- Confirm boundaries

- Check government acquisition status

- Prevent encroachment issues

Skipping this step is gambling.

4. Inspect the Location Physically

Visit the land yourself.

Check:

- Road access

- Flood risk

- Neighborhood development

Pictures lie. Reality doesn’t.

5. Use Trusted Professionals

Many land problems come from “agents” with no accountability.

Work with professionals who:

- Verify documents

- Guide negotiations

- Protect your interest

This is especially important for diaspora buyers.

IN OTHER NEWS: Guide to buying property from companies in Nigeria

Conclusion

If Mr. Abraham had taken time to verify documents, inspect the land, and seek professional help, his story would have ended differently.

Buying land in Nigeria can be rewarding —but only when you do it right.

Knowing the things to look out for before trying to buy property in Nigeria protects your money, your peace, and your future.

Ready to Buy Property in Nigeria?

Connect with House & Land Naija Today

🌐 Website: https://houseandlandnaija.com

📧 Email: hello@houseandlandnaija.com

📍 Offices:

Nigeria — 9 Moses Adebajo Street, Ojodu-Berger, Lagos

USA — 8500 Frederickburgs Lane, Houston TX 77083

Canada — 102-30 El-Tassi Drive, Winnipeg MB

📞 Call Us:

Nigeria: +234 707 491 3626 | +234 707 491 3631

Canada: +1 (431) 990-3777

USA: +1 (832) 847-5261

👉 Before you buy any land, talk to us. We’ll help you verify, secure, and invest safely.

Beyond the Façade: How Nigeria’s Infrastructure Gap Impacts Your Real Estate Investment (And How to Bridge It)

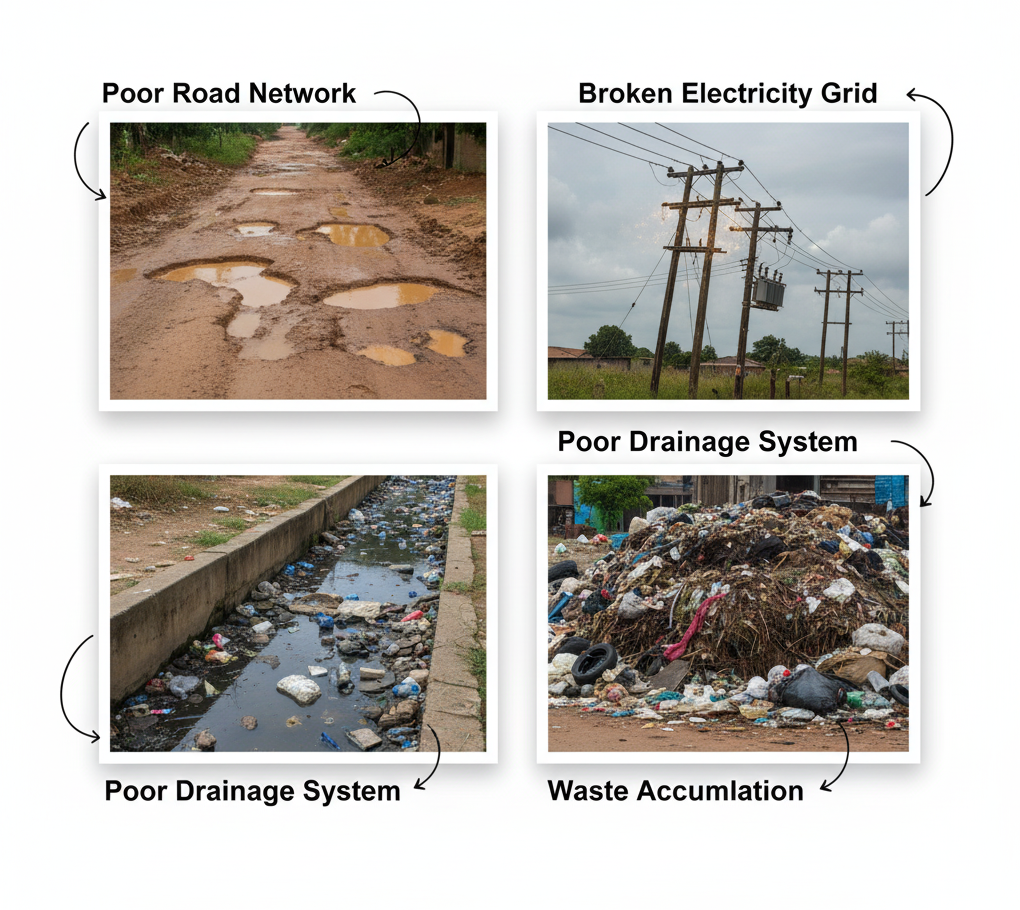

Poor Infrastructure – A Threat to Your Real Estate Investments

Imagine yourself in this situation: You’ve found the perfect plot of land or a beautiful new build in a seemingly promising area of Nigeria. The price is right, the layout is fantastic, and you’re envisioning years of steady returns or comfortable living. You make the purchase, excited. Then, the reality sets in. The access road is a nightmare, power is a luxury, water is a daily quest, and during the rainy season, your street becomes a river. This isn’t just an inconvenience; it’s a direct threat to your investment’s value and your peace of mind. Sadly, this scenario aptly describes how Nigeria’s infrastructure gap impacts your real estate investment!

While Nigeria’s real estate market boasts immense potential, one of its most persistent and impactful challenges lies hidden, often until it’s too late: inadequate infrastructure. This isn’t merely about inconvenience; it’s a critical factor that can make or break your property investment. At House and Land Naija, we understand these nuances and are here to guide you through them.

READ MORE: Madison Apartments is Your Key to a Secure and Modern Lagos Lifestyle!

The Pervasive Problem: What We Mean by “Inadequate Infrastructure”

When we talk about infrastructure, we’re referring to the fundamental facilities and systems serving a country, city, or area. In Nigeria, key deficits include:

- Road Networks: Many promising areas lack paved, well-maintained roads, leading to difficult access, vehicle damage, and increased travel times. This is particularly prevalent in developing estates and peri-urban areas.

- Electricity Supply: The national grid often struggles to provide consistent power, forcing property owners to rely heavily on expensive and noisy generators or increasingly, solar power solutions.

- Water Supply: Access to potable tap water is not universal, requiring reliance on boreholes, water tankers, and private filtration systems.

- Drainage Systems: Poor or non-existent drainage is a major contributor to perennial flooding in many urban and suburban areas, damaging properties and making areas uninhabitable during rainy seasons.

- Waste Management: Inefficient waste collection and disposal systems can lead to environmental pollution and health hazards, impacting property aesthetics and value.

Expert Insight: The Hidden Costs and Value Erosion

Real estate analysts consistently point out that a lack of essential infrastructure doesn’t just reduce convenience; it directly impacts property value and increases the true cost of ownership.

“When public infrastructure is lacking, developers and homeowners are forced to become mini-governments,” explains Dr. Ngozi Okonjo, a prominent Nigerian real estate economist. “They have to build their own roads, sink boreholes, install private power solutions. These are significant upfront and ongoing costs that eat into profit margins for developers and add to the financial burden for property owners, ultimately depressing the property’s market value.”

Essentially, if you buy a property in an area with poor infrastructure, you’re not just buying the land and structure; you’re also implicitly inheriting the responsibility (and cost) of providing or supplementing these basic amenities yourself. This dramatically affects rental yields, resale value, and tenant satisfaction. This is how Nigeria’s infrastructure gap impacts your real estate investment eventually.

How to Overcome This Challenge: Strategies for Smart Investors

While the government continues to work on large-scale infrastructure projects, smart investors can take proactive steps to mitigate risks and even find opportunities:

- Thorough Site Inspection and Research:

- Go Beyond the Surface: Don’t just view the property during the dry season or on a sunny day. Visit the location multiple times, especially during heavy rainfall, to assess drainage and road conditions.

- Talk to Locals: Speak with existing residents. They are the best source of unfiltered information regarding the reliability of electricity, water, and security.

- Investigate Development Plans: Research local and state government development plans. Are there approved road projects, power initiatives, or water schemes slated for the area? A professional real estate consultant can help uncover this critical information.

- Budget for Independent Utilities:

- Factor in Self-Sufficiency: Assume you might need to provide some utilities. Include the cost of solar power installations, inverter systems, boreholes, water treatment plants, or reliable generator setups in your overall investment budget. This ensures your property remains functional and attractive to tenants or buyers.

- Prioritize Locations with Existing or Planned Infrastructure:

- Focus on Developed Estates: Properties within well-managed, private estates often come with better infrastructure (paved roads, streetlights, central water, security) built in by the developers. While initially more expensive, they can offer better long-term value and fewer headaches.

- Monitor Emerging Hubs: Look for areas where significant government or private sector infrastructure projects are underway or recently completed. These areas are poised for rapid appreciation.

- Consider Public-Private Partnerships (PPPs) or Community Initiatives:

- Collective Solutions: In some cases, communities or investor groups can collaborate with local governments or private firms to fund and develop localized infrastructure. While complex, these initiatives can significantly boost property values.

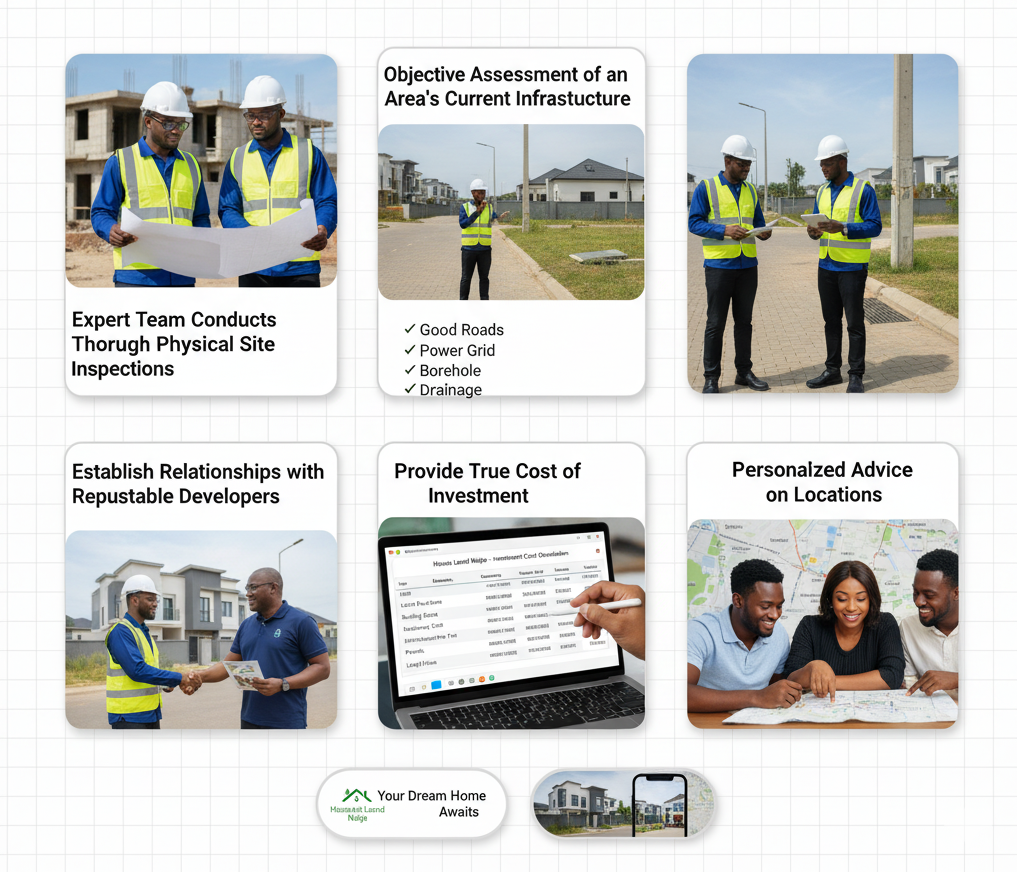

How House and Land Naija Can Assist You

At House and Land Naija, we are more than just property brokers; we are your strategic partners in the Nigerian real estate market. We specialize in navigating these complex infrastructure challenges on your behalf:

- Deep-Dive Due Diligence: Our expert team conducts thorough physical site inspections and leverages local intelligence to assess the true state of infrastructure in your target areas, identifying potential pitfalls before you commit.

- Infrastructure Audit & Projection: We provide an objective assessment of an area’s current infrastructure and, based on our market research, project future developments, helping you make informed decisions.

- Access to Prime Estates: We have established relationships with reputable developers of well-serviced estates, offering you vetted properties that come with guaranteed infrastructure.

- Cost-Benefit Analysis: We help you understand the true cost of investment, factoring in potential expenses for supplementary utilities, so there are no surprises down the line.

- Expert Consultation: Our consultants provide personalized advice on locations that align with your infrastructure tolerance and investment goals, helping you avoid areas that might drain your resources.

IN OTHER NEWS: Building demolitions, collapses haunt real estate sector

From Panic to Power

It is clear how Nigeria’s infrastructure gap impacts your real estate investment, but don’t let inadequate infrastructure turn your dream investment into a costly nightmare. The success of your real estate venture in Nigeria hinges on a clear understanding of these foundational elements. With the right guidance, you can secure properties that not only appreciate in value but also offer the quality of life and functionality you expect.

📢 Connect with House & Land Naija Today

Ready to invest smartly and confidently in Nigeria’s real estate market? Don’t leave your investment to chance. Contact House and Land Naija today for a free consultation. Let us help you find properties in areas with the robust infrastructure you deserve, ensuring your investment stands on solid ground.

🌐 Website: https://houseandlandnaija.com

📧 Email: hello@houseandlandnaija.com

📍 Our Offices Worldwide

- Canada: 102-30 El-Tassi Drive, Winnipeg MB, Canada

- USA: 8500 Frederickburgs Lane, Houston TX 77083

- Nigeria: 9 Moses Adebajo Street, Ojodu-Berger, Lagos

📞 Call Us Anytime

- Canada: +1 (431) 990-3777

- USA: +1 (832) 847-5261

- Nigeria: +234 707 491 3626 | +234 707 491 3631

Start smart. Invest wisely. Let inflation be your stepping stone, not your stumbling block.

Madison Apartments is Your Key to a Secure and Modern Lagos Lifestyle!

A Place to Call Home: Where Lagos Hustle Meets Modern Serenity

For the Nigerian professional, the dream is clear: to build a life of success, comfort, and security. For our brothers and sisters in the diaspora, the vision is even more potent—a beautiful, hassle-free haven back home in Nigeria; a tangible symbol of your achievements and a secure landing pad for your family. But have you heard about Madison Apartments, your key to a secure and modern Lagos lifestyle?

Yes, the Lagos property market can often feel like a maze. The concerns are universal: Will the title be secure? Will there be light and water? Will my family be safe? These worries can overshadow the excitement of owning a premium property.

So if you are searching for a home that not only answers these concerns but exceeds every expectation, you have just found it. That dream is now a concrete reality at Madison Apartments, nestled in the vibrant heart of Aguda, Surulere.

READ MORE: Hidden Costs to Watch Out For When Buying Properties in Nigeria

More Than an Address, It’s a Statement

Madison Apartments isn’t just another building; it’s a testament to modern living, designed for those who refuse to compromise. We understand that your home is your sanctuary—a place to recharge from the city’s vibrant energy and thrive in peace.

This is your invitation to step into a lifestyle where luxury is standard and peace of mind is guaranteed.

Imagine Your Life at Madison Apartments, Surulere

Picture this: You drive through a secure, gated entrance into a serene environment—a world away from the city’s chaos. Your car is safely parked in a covered parking space. You’re greeted by friendly, professional security personnel monitored by 24/7 CCTV cameras and protected by an electric fence.

You step into your apartment, and the air is cool. The uninterrupted 24/7 power supply means no humming generators or unexpected blackouts. You fancy a warm bath after a long day? The water heater is ready. Feel like a workout? The fully-equipped gym awaits without you having to leave the comfort of your community.

This isn’t a far-off fantasy. This is the daily reality awaiting you at Madison.

Signature Features Designed for You

We have meticulously curated every detail to ensure a seamless and luxurious living experience:

- Move-In Ready Luxury: Enjoy soft furnishing and a fitted kitchen for a hassle-free move. Just bring your personal touch.

- Unbreachable Security: Sleep soundly with 24/7 security, CCTV surveillance, an electric fence, and smart locks for enhanced access control.

- Modern Conveniences: Stay connected and comfortable with constant power and water supply.

- Health & Wellness: Maintain your routine in the on-site, fully-equipped gym.

Your Investment, Secured

We make the journey to homeownership transparent and straightforward.

- Location: Aguda, Surulere, Lagos State. A prime, accessible, and well-established neighborhood.

- Approval Status: Fully Approved with a Certificate of Occupancy (C of O). Your investment is legally protected—no stories.

- Development Status: Construction has commenced and is progressing steadily towards completion.

- Delivery Date: 2026

Available Properties & Flexible Payment Plan

We offer exquisite layouts to suit your needs:

- Spacious 3 Bedroom Apartments: (2 rooms at 37sqm, 1 room at 30sqm) – Perfect for growing families.

- Modern 2 Bedroom Apartments: (1 room at 46sqm, second room at 33sqm) – Ideal for young professionals and couples.

Our Payment Plan is designed for ease:

- 40% deposit, with the balance spread over a comfortable 6-month period.

A Message to Our Diaspora Family

We see you. We understand the unique challenge of investing from thousands of miles away. With offices in Houston, Texas, and Canada, House and Land Naija bridges that gap. Our team provides transparent updates, virtual tours, and trusted client management, making your investment process smooth and secure. This is more than a property; it’s your rooted connection to home.

Your Dream Home Awaits. Don’t Let It Slip Away.

A property of this standard, in this location, with these features, will not stay available for long. The opportunity to secure a fully-approved home with a stress-free payment plan is rare.

This is your moment to stop imagining and start living. And this is your chance to provide your family with the security and comfort they deserve. This is your investment in a tangible, appreciating asset right in the heart of Lagos.

IN OTHER NEWS: Nigeria’s Real Estate Market Faces a New Reality as Inflation Falls and Rates Stay High

✅ Take Action Today – Don’t Wait!

The life you’ve worked so hard for is within reach. Do not let hesitation cost you this opportunity. Indeed, Madison Apartments is your key to a secure and modern Lagos lifestyle!

Take the first step towards your new home today. Your future self will thank you.

📢 Connect with House and Land Naija Today

🌐 Website: https://houseandlandnaija.com

📞 Call: +234 802 323 0122 | +234 707 491 3631

👉 Secure your unit now and own your dream home in Surulere by 2026 with House and Land Naija! Your key to a modern, secure, and serene lifestyle in Lagos is just one conversation away.

House and Land Naija: Building Dreams, Securing Futures.

Lagos | Port Harcourt | Houston, Texas | Canada

Hidden Costs to Watch Out For When Buying Properties in Nigeria

What every Nigerian at home — and in the Diaspora — must know before they sign, pay, or build.

A Diaspora Cautionary Tale

Ufuoma had been saving for years while working in Dubai. She found a “sweet” plot in Lekki online and thought she’d secured a bargain. She wired the seller an upfront allocation fee, then paid for a surveyor and a builder — only to discover later she still needed governor’s consent, a long court search, and an unexpected infrastructure levy from the developer. The small “hidden” fees snowballed, and her savings were stretched thin. No one told her that were hidden costs to watch out for when buying properties in Nigeria. With better planning, a trusted agent and a 20% contingency fund, Ufuoma would have avoided stress and preserved cash for construction!

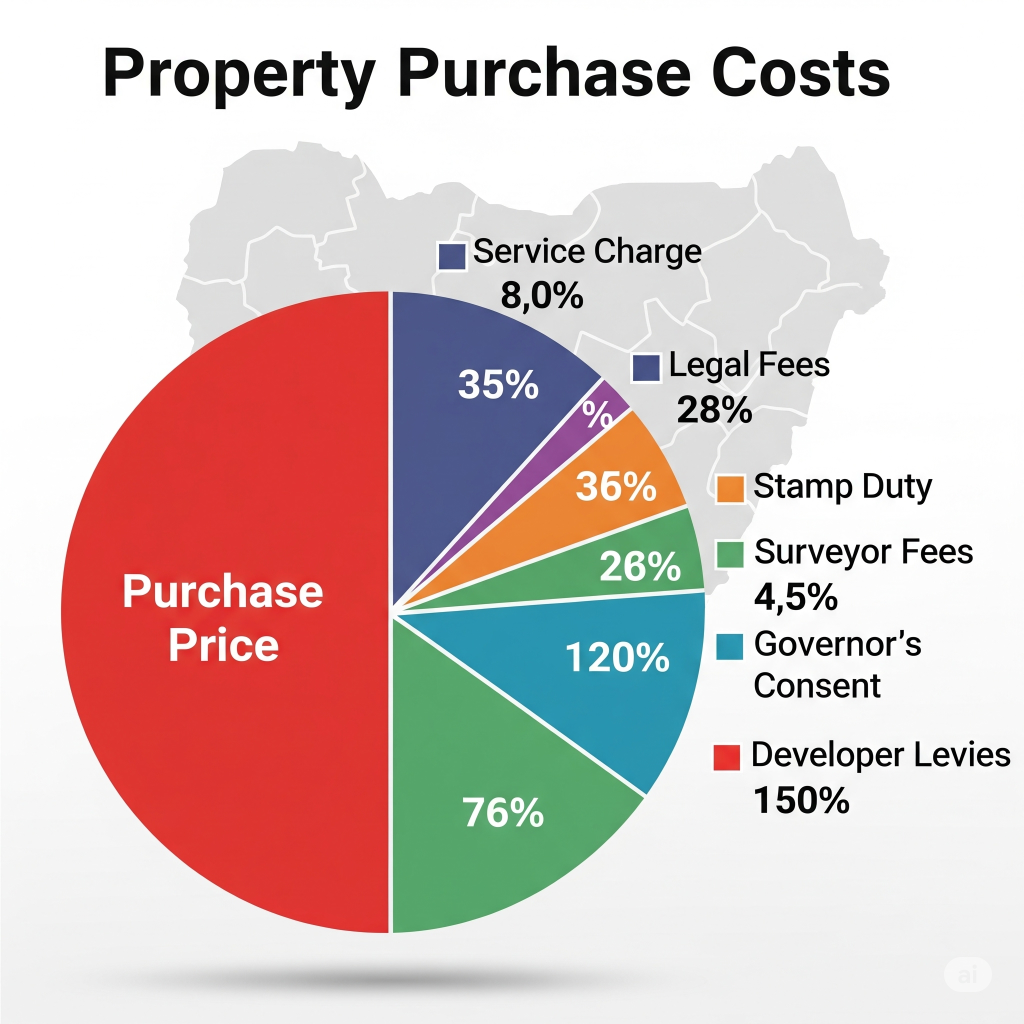

If you’re buying property in Nigeria — whether you’re in Lagos or abroad — Ufuoma’s story should be your wake-up call: the purchase price is only the beginning.

Why This Matters To You

Hidden costs can add 10%–40% (sometimes more) to your out-of-pocket total, delay your project, and expose you to legal risk. Understanding them upfront protects your money, timing, and long-term returns. So if you live abroad and desire to own a property in Nigeria, this article will show you all the hidden costs to watch out for when buying properties in Nigeria!

READ MORE: DIASPORA DOLLARS, REAL RISK: HOW TO AVOID LAND SCAMS IN NIGERIA!

The Full List — Hidden Costs Every Buyer Must Watch For

Below are the usual suspects and how they commonly show up. I list each cost, why it matters, who typically charges it, and how to manage or reduce it.

1) Agent / Finder’s Commission

- What it is: Fee paid to the estate agent or broker for sourcing the property.

- Why it matters: Often 2–7% of the sale price (varies by agreement). Can be added to your price unexpectedly.

- How to manage: Agree fees in writing before any viewing or negotiation. If you’re overseas, use an agent you’ve vetted and paid via escrow.

2) Legal Fees & Conveyancing Costs

- What it is: Lawyer fees to draft/pull title docs, carry out due diligence, draft the sale agreement, and handle registration.

- Why it matters: You need a lawyer to avoid title problems; cutting corners risks losing everything.

- How to manage: Request an itemized quote and scope of work. Use lawyers who specialize in property conveyancing and ask for references.

3) Title Searches / Land Registry & Search Fees

- What it is: Official searches at the state land registry, court checks for litigation, and search certificates.

- Why it matters: Proves whether a property has encumbrances or multiple claims. Missing this = high legal risk.

- How to manage: Don’t accept verbal assurances. Require registry certificates and copies of searches before payment.

4) Surveyor Fees & Revalidation of Survey Plans

- What it is: Professional survey to verify boundaries, peg positions, and area — and fees to update or revalidate old survey plans.

- Why it matters: Prevents double-sales; ensures you buy the plot you think you bought.

- How to manage: Always instruct an independent licensed surveyor; require a stamped survey plan as a condition of sale.

5) Governor’s Consent (where applicable) & Certificate Issuance Fees

- What it is: For certain transfers (e.g., from an individual), state law requires governor’s consent; this attracts processing fees and sometimes time.

- Why it matters: Transfers without proper consent can be voidable. It can be costly and time-consuming.

- How to manage: Confirm whether consent is required for your transaction and budget time and money for the process.

6) Stamp Duty & Registration Fees

- What it is: Government taxes on instruments and formal registration fees. Rates vary by state and document type.

- Why it matters: Stamp duty is legally required; an unstamped instrument may not be admissible in court. Registration legalizes ownership.

- How to manage: Ask your lawyer to calculate and include these in the closing budget; obtain official receipts.

7) Allocation fees, Development Levies & ‘Estate’ Charges (Developer Fees)

- What it is: Charges by developers for allocating a plot, and later charges for roadworks, drainage, gatehouses, or “facilities development”.

- Why it matters: Some developers bill major levies after allocation; ignore at your peril.

- How to manage: Get a full, written breakdown of developer fees before paying. Insist on escrow for major payments.

8) Service Charges / Estate Maintenance / Homeowners’ Association (HOA) Fees

- What it is: Recurring fees for security, road maintenance, landscaping and utilities in gated communities.

- Why it matters: These are recurring and impact your annual cost of ownership. Some estates charge upfront lump sums.

- How to manage: Clarify recurring amounts, billing frequency, and what they cover. Factor into long-term running costs.

9) Utility Connection Costs (Electricity, Water, Fiber)

- What it is: Meter installations, service connection fees from providers, or paying for trenching/connection work.

- Why it matters: These can be sizeable, especially for rural plots or new estates.

- How to manage: Ask the developer or local utility provider for connection quotes before you commit.

10) VAT on Materials, Contractor Bills & Building Permit Fees

- What it is: VAT on construction materials and services; permit fees for building plans and approvals.

- Why it matters: Construction is expensive; VAT and permit costs will increase your budget.

- How to manage: Budget for VAT and include it in construction quotes. Factor local planning and permit timelines into schedule.

11) Infrastructure / Impact Levies and Local Government Charges

- What it is: Town planning levies, drainage contributions or environmental levies assessed by local authorities.

- Why it matters: They can be demanded later as cities formalize services.

- How to manage: Confirm with the developer and local authority what levies exist and whether they’ve been paid.

12) Ground Rent or Customary Land Charges

- What it is: For certain customary lands, annual dues or payments to traditional rulers may be expected.

- Why it matters: These reappear annually and can cause tension if ignored.

- How to manage: Clarify any customary obligations with community leaders and put them in writing.

13) Mortgage / Loan Arrangement Fees, Valuation Fees and Insurance

- What it is: Bank processing fees, legal fees charged by lenders, valuation fees and life/home insurance.

- Why it matters: Borrowing costs add materially to loan TCO. Some banks charge non-refundable processing fees.

- How to manage: Shop lenders, compare fees, and get a full amortization schedule from the bank.

IN OTHER NEWS: How Real Estate Displaced Crude Oil as Nigeria’s Third Largest GDP Contributor

14) Exchange-rate Losses and Foreign Transfer Charges (for Diaspora)

- What it is: When sending funds from abroad you will pay FX spreads, bank charges and sometimes poor conversion rates.

- Why it matters: Can consume several percentage points of your transferred capital.

- How to manage: Use trusted remittance services, ask for Nigerian-naira invoices, and plan transfers when exchange rates are favorable.

15) Title Insurance (optional but useful)

- What it is: Insures against title defects, fraud, or title disputes that emerge after purchase.

- Why it matters: It’s an extra cost but can be a lifesaver if title risk is non-trivial.

- How to manage: Where available, compare policies and weigh cost vs. risk for high-value purchases.

16) Unexpected Construction Cost Overruns & Contingency

- What it is: Material price inflation, design changes, or site surprises (soil issues, remediation).

- Why it matters: Construction often exceeds budget. Unforeseen costs can derail projects.

- How to manage: Hold a contingency fund (10–25% common) and use fixed-price contracts where possible.

17) Taxes & Annual Property Rates (Local Government)

- What it is: Annual property tax/rates charged by local authorities; enforcement is rising in many urban areas.

- Why it matters: Recurring tax that affects holding cost and net returns.

- How to manage: Clarify tax obligations with local government and build into your cash flow.

So if you live abroad and desire to own a property in Nigeria, this article has shown you all there is to know about the hidden costs to watch out for when buying properties in Nigeria!

Practical checklist — Budget and Negotiation Steps (Use This Before You Sign Anything)

- Ask for a full cost breakdown (sale price + every fee).

- Confirm who pays what (seller vs buyer vs developer).

- Insist on original documents (C of O, survey plan, allocation letter).

- Order an independent survey and lawyer-conducted title search.

- Ask for escrow or lawyer trust account for all major payments.

- Check for developer levies and any post-allocation fees in writing.

- Plan a contingency of 10–25% of total budget.

- If abroad: use geo-tagged video, drone footage and a trusted on-the-ground rep.

- Get a signed receipt for every payment and official transaction evidence.

- Ask for copies of service charge agreements and estate rules.

How Following These Recommendations Benefits You

- Greater Certainty — no surprise fees after you commit.

- Legal Safety — fewer chances of losing your purchase to title defects.

- Better Returns — protecting capital increases your net ROI when you sell or rent.

- Peace of mind — you can invest from overseas without fear, using verifiable processes.

- Project success — fewer delays from unpaid levies, missing permits or misbudgeted builds.

In Conclusion

Buying property in Nigeria is one of the best ways to build wealth — but only when you plan for the full cost. Hidden fees don’t have to be a surprise. With the right lawyer, surveyor and trusted partner on the ground, you can invest confidently from anywhere in the world. So if you live abroad and desire to own a property in Nigeria, this article has shown you all the hidden costs to watch out for when buying properties in Nigeria!

If you want, House and Land Naija can:

- verify title documents on your behalf,

- arrange independent surveys and drone inspections,

- hold funds in escrow with a trusted lawyer, and

- provide an itemized closing budget so you know every naira you’ll need.

Let us help you buy smart and build your legacy.

Contact House and Land Naija to get a full purchase cost worksheet for any property you’re considering.

Ready to Invest with Confidence? Contact House and Land Naija Today

- Visit: houseandlandnaija.com

- Address: Nigeria Office – 9 Moses Adebajo Street, Ojodu, Lagos State

- Address: Canada Office – 102‑30 El‑Tassi Drive, Winnipeg MB, Canada

- Address: USA Office: 8500 Fredericksburg Lane, Houston TX 77083

- Phone (Canada): +1 (431) 990‑3777

- Phone (USA): +1 (833) 323‑4927

- Phone (Nigeria): 070 7 491 36 38

Join the thousands of Nigerians—home and abroad—who’ve secured legitimate, high-value property deals.