Beyond the Façade: How Nigeria’s Infrastructure Gap Impacts Your Real Estate Investment (And How to Bridge It)

Poor Infrastructure – A Threat to Your Real Estate Investments

Imagine yourself in this situation: You’ve found the perfect plot of land or a beautiful new build in a seemingly promising area of Nigeria. The price is right, the layout is fantastic, and you’re envisioning years of steady returns or comfortable living. You make the purchase, excited. Then, the reality sets in. The access road is a nightmare, power is a luxury, water is a daily quest, and during the rainy season, your street becomes a river. This isn’t just an inconvenience; it’s a direct threat to your investment’s value and your peace of mind. Sadly, this scenario aptly describes how Nigeria’s infrastructure gap impacts your real estate investment!

While Nigeria’s real estate market boasts immense potential, one of its most persistent and impactful challenges lies hidden, often until it’s too late: inadequate infrastructure. This isn’t merely about inconvenience; it’s a critical factor that can make or break your property investment. At House and Land Naija, we understand these nuances and are here to guide you through them.

READ MORE: Madison Apartments is Your Key to a Secure and Modern Lagos Lifestyle!

The Pervasive Problem: What We Mean by “Inadequate Infrastructure”

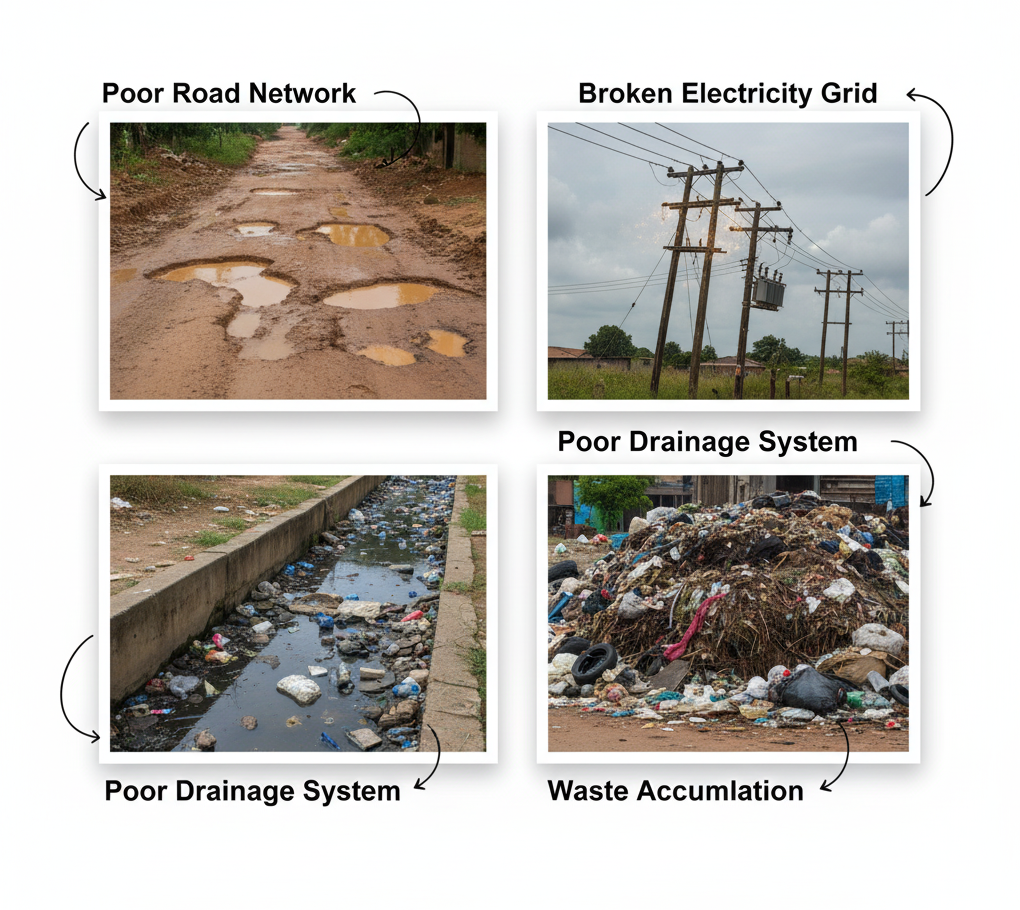

When we talk about infrastructure, we’re referring to the fundamental facilities and systems serving a country, city, or area. In Nigeria, key deficits include:

- Road Networks: Many promising areas lack paved, well-maintained roads, leading to difficult access, vehicle damage, and increased travel times. This is particularly prevalent in developing estates and peri-urban areas.

- Electricity Supply: The national grid often struggles to provide consistent power, forcing property owners to rely heavily on expensive and noisy generators or increasingly, solar power solutions.

- Water Supply: Access to potable tap water is not universal, requiring reliance on boreholes, water tankers, and private filtration systems.

- Drainage Systems: Poor or non-existent drainage is a major contributor to perennial flooding in many urban and suburban areas, damaging properties and making areas uninhabitable during rainy seasons.

- Waste Management: Inefficient waste collection and disposal systems can lead to environmental pollution and health hazards, impacting property aesthetics and value.

Expert Insight: The Hidden Costs and Value Erosion

Real estate analysts consistently point out that a lack of essential infrastructure doesn’t just reduce convenience; it directly impacts property value and increases the true cost of ownership.

“When public infrastructure is lacking, developers and homeowners are forced to become mini-governments,” explains Dr. Ngozi Okonjo, a prominent Nigerian real estate economist. “They have to build their own roads, sink boreholes, install private power solutions. These are significant upfront and ongoing costs that eat into profit margins for developers and add to the financial burden for property owners, ultimately depressing the property’s market value.”

Essentially, if you buy a property in an area with poor infrastructure, you’re not just buying the land and structure; you’re also implicitly inheriting the responsibility (and cost) of providing or supplementing these basic amenities yourself. This dramatically affects rental yields, resale value, and tenant satisfaction. This is how Nigeria’s infrastructure gap impacts your real estate investment eventually.

How to Overcome This Challenge: Strategies for Smart Investors

While the government continues to work on large-scale infrastructure projects, smart investors can take proactive steps to mitigate risks and even find opportunities:

- Thorough Site Inspection and Research:

- Go Beyond the Surface: Don’t just view the property during the dry season or on a sunny day. Visit the location multiple times, especially during heavy rainfall, to assess drainage and road conditions.

- Talk to Locals: Speak with existing residents. They are the best source of unfiltered information regarding the reliability of electricity, water, and security.

- Investigate Development Plans: Research local and state government development plans. Are there approved road projects, power initiatives, or water schemes slated for the area? A professional real estate consultant can help uncover this critical information.

- Budget for Independent Utilities:

- Factor in Self-Sufficiency: Assume you might need to provide some utilities. Include the cost of solar power installations, inverter systems, boreholes, water treatment plants, or reliable generator setups in your overall investment budget. This ensures your property remains functional and attractive to tenants or buyers.

- Prioritize Locations with Existing or Planned Infrastructure:

- Focus on Developed Estates: Properties within well-managed, private estates often come with better infrastructure (paved roads, streetlights, central water, security) built in by the developers. While initially more expensive, they can offer better long-term value and fewer headaches.

- Monitor Emerging Hubs: Look for areas where significant government or private sector infrastructure projects are underway or recently completed. These areas are poised for rapid appreciation.

- Consider Public-Private Partnerships (PPPs) or Community Initiatives:

- Collective Solutions: In some cases, communities or investor groups can collaborate with local governments or private firms to fund and develop localized infrastructure. While complex, these initiatives can significantly boost property values.

How House and Land Naija Can Assist You

At House and Land Naija, we are more than just property brokers; we are your strategic partners in the Nigerian real estate market. We specialize in navigating these complex infrastructure challenges on your behalf:

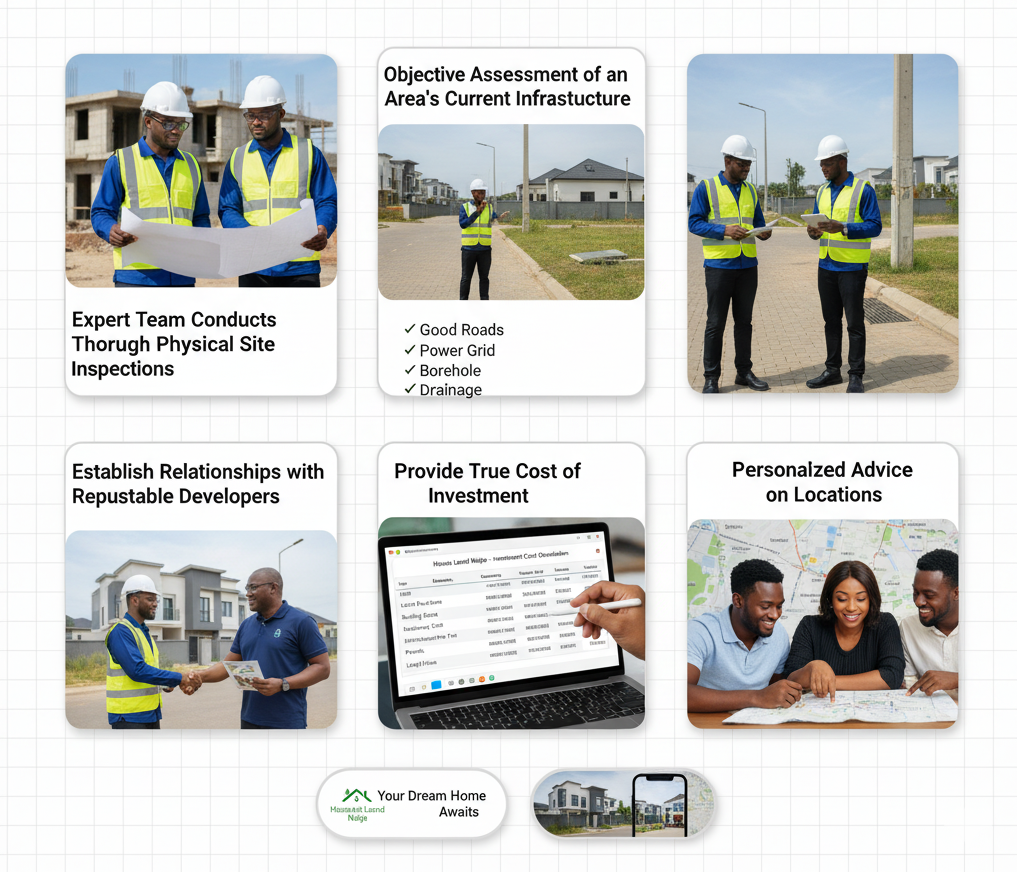

- Deep-Dive Due Diligence: Our expert team conducts thorough physical site inspections and leverages local intelligence to assess the true state of infrastructure in your target areas, identifying potential pitfalls before you commit.

- Infrastructure Audit & Projection: We provide an objective assessment of an area’s current infrastructure and, based on our market research, project future developments, helping you make informed decisions.

- Access to Prime Estates: We have established relationships with reputable developers of well-serviced estates, offering you vetted properties that come with guaranteed infrastructure.

- Cost-Benefit Analysis: We help you understand the true cost of investment, factoring in potential expenses for supplementary utilities, so there are no surprises down the line.

- Expert Consultation: Our consultants provide personalized advice on locations that align with your infrastructure tolerance and investment goals, helping you avoid areas that might drain your resources.

IN OTHER NEWS: Building demolitions, collapses haunt real estate sector

From Panic to Power

It is clear how Nigeria’s infrastructure gap impacts your real estate investment, but don’t let inadequate infrastructure turn your dream investment into a costly nightmare. The success of your real estate venture in Nigeria hinges on a clear understanding of these foundational elements. With the right guidance, you can secure properties that not only appreciate in value but also offer the quality of life and functionality you expect.

📢 Connect with House & Land Naija Today

Ready to invest smartly and confidently in Nigeria’s real estate market? Don’t leave your investment to chance. Contact House and Land Naija today for a free consultation. Let us help you find properties in areas with the robust infrastructure you deserve, ensuring your investment stands on solid ground.

🌐 Website: https://houseandlandnaija.com

📧 Email: hello@houseandlandnaija.com

📍 Our Offices Worldwide

- Canada: 102-30 El-Tassi Drive, Winnipeg MB, Canada

- USA: 8500 Frederickburgs Lane, Houston TX 77083

- Nigeria: 9 Moses Adebajo Street, Ojodu-Berger, Lagos

📞 Call Us Anytime

- Canada: +1 (431) 990-3777

- USA: +1 (832) 847-5261

- Nigeria: +234 707 491 3626 | +234 707 491 3631

Start smart. Invest wisely. Let inflation be your stepping stone, not your stumbling block.